|

| This week's gainers and losers |

| Gainers: Vistra (+20%): The market welcomed the arrival of Energy Harbor in the portfolio of the Texas-based company, for $3 billion and a 15% stake in Vistra Vision. This entity is a new subsidiary of Vistra, designed to accommodate the existing nuclear, renewable, storage and distribution assets, added to those of Energy Harbor in the same areas. John Wood (+13%): Speculation has resumed on the Scottish oil engineering company, which is still being courted by the Apollo fund, which has increased its initial offer for the third time. It has reportedly offered GBp 237 per share, a price that the company's management still considers too low. Dick's Sporting Goods (+13%): The 2022 results, the 2023 forecast and the dividend are all above expectations for the American network of sporting goods stores. Investors also appreciated the way management reduced its inventory, which allows the company to start the new fiscal year in the best conditions. SMA Solar (+10%): Here again, this increase is based on the 2022 results and the 2023 outlook. The solar energy specialist had a dynamic year-end, marked by an influx of contracts. Research firm Jefferies has confirmed its buy recommendation. Losers: SVB Financial (-63%): The Silicon Valley bank threw a spanner in the works on Thursday afternoon by announcing that it needed fresh capital after being forced to sell a bond portfolio at a loss. Investors fled the stock, which collapsed. Western Alliance Bancorporation (-32%) First Republic Bank (-32%) In the wake of SVB, all banking stocks, even the biggest ones, were attacked after the SVB episode. Western Alliance Bancorporation and First Republic Bank are the hardest hit so far. OVH (-16%): The stock of the leader in digital hosting has been heckled this week because of a large sale of shares by KKR and TowerBrook. In such a situation, the sellers have to offer an attractive price for the market to absorb the paper, i.e. a price below the current stock market prices. As a result, there is strong pressure on the share from time to time. |

|

| Commodities |

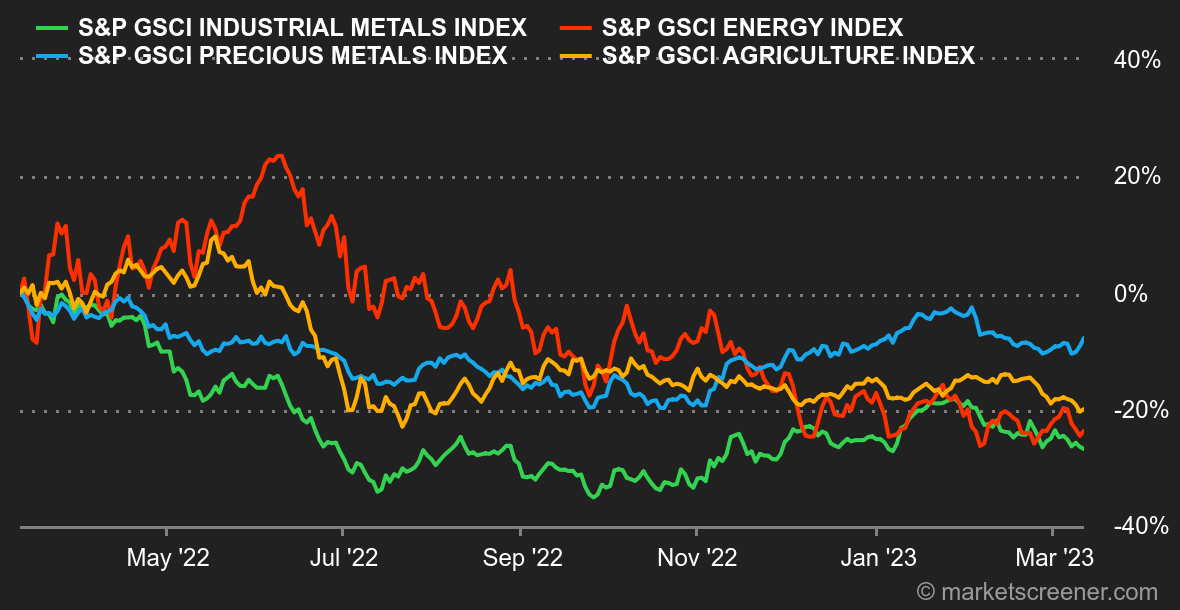

| Energy: Oil prices have been hit by several headwinds, starting with mixed economic data from China, whose crude oil imports contracted by just over 1% year-on-year in February. Next, it was Jerome Powell's statements that weighed on the prices of risky assets, including oil. The Federal Reserve Chairman has hardened his stance and prepared investors for more rate hikes in order to curb inflation. U.S. weekly inventories recorded their first decline of the year. They decreased by 1.7 million barrels while the market was expecting a further increase of about 1.3 million. In terms of prices, Northern European Brent and U.S. WTI prices fell to USD 81 and USD 75 per barrel respectively. For natural gas in Europe, the Rotterdam TTF is treading water at around 46 EUR/MWh. Metals: Base metal prices also took a downward path this week. The latest annual meeting of the Chinese parliament did not generate any particular excitement. Traders were certainly expecting the announcement of new stimulus packages that would boost demand for industrial metals, but this did not happen. In addition, Beijing reported a contraction in copper imports in the first two months of the year of around 10% year-on-year, undermining financial sentiment. A ton of copper is trading at around USD 8820 on the LME, compared to USD 23225 for nickel and 2290 for aluminum. Gold, for its part, is stabilizing at USD 1835. China (again), has increased its gold holdings with a purchase of 25 tons last month. Agricultural commodities: Grain prices are down again this week, despite warnings from the Australian Bureau of Agriculture, which expects a sharp decline in crop production due to abnormally dry weather. In Chicago, a bushel of wheat is trading lower at 665 cents, as is a bushel of corn at 610 cents. |

|

| Macroeconomics |

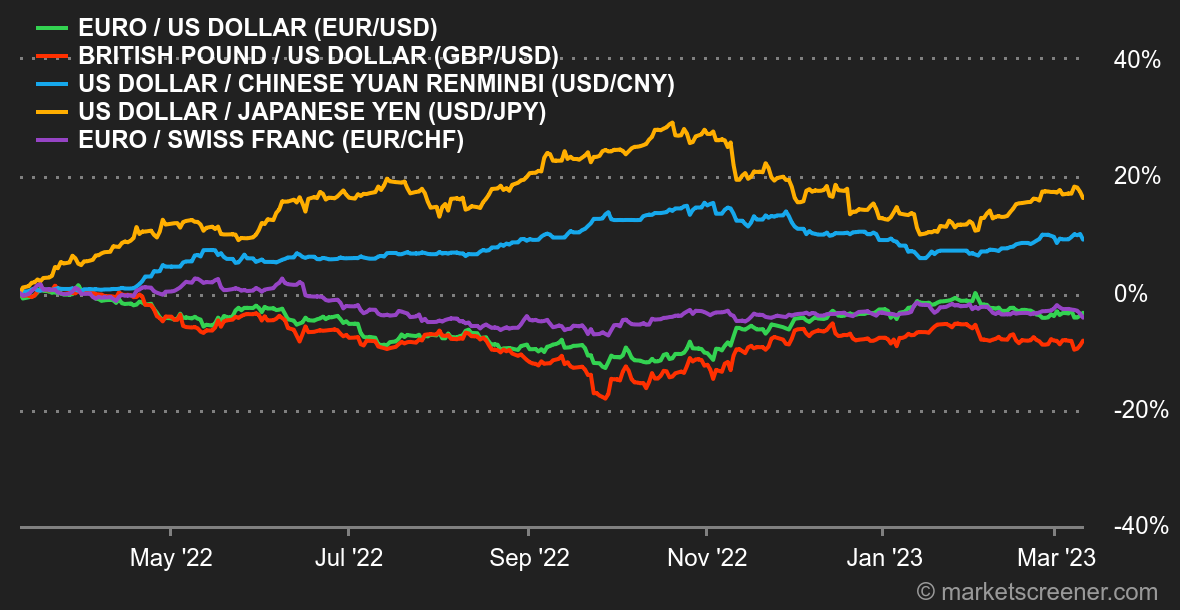

| Atmosphere. There were three phases in the markets this week. First, the Fed's hardening stance in relation to the path of rates, which caused investors to change their predictions for the central bank's next move on March 22. From a 25 basis point hike, the majority went to 50 basis points. Then, on Thursday, a big mess caused by the woes of the Californian bank SVB Financial, which put the financial sector in trouble and pushed bond yields down. Finally, the third phase on Friday: US labor market statistics for February that pointed in the direction of a moderation in rate hikes. While job creation remained robust, hourly wage growth slowed and the unemployment rate rose to 3.6%. Yields fell further and the forecast of a 25 basis-point rate hike has returned. Currencies. Friday's U.S. jobs numbers sent the dollar lower, for the reasons explained above. The Dollar Index broke out of the 105.20 area and retreated to around 104.80. The euro was trading at $1.63 at the end of the week. Commodity-linked currencies had a complicated week, especially the Aussie, whose losses exceeded 1.5% against the euro, dollar and pound. Rates: While Jerome Powell's speech logically turned out to be more hawkish than dovish, the markets were feverishly waiting for the release of the US job creation figures in order to confirm the Fed's hawkish stance. Until now, at least since last October, equity markets have moved in the opposite direction to government bond yields. However, this weekend has seen a reversal of fortunes. The risks inherent in the SVB have resulted in a classic "fly to quality" movement, with investors preferring to switch to bonds and away from equity markets. However, this paradigm shift needs to be confirmed in the coming sessions. A first element of answer should be provided to us next Tuesday with the publication of the CPI. To be continued. Cryptocurrencies. Bitcoin is falling heavily by 11% this week and is once again flirting with the $20,000 mark at the time of writing. With the collapse of the crypto-friendly Silvergate bank, the increasing regulatory crackdown on ecosystem players in the United States, and the backdrop of a macroeconomic environment that is struggling to provide positive catalysts to sustainably revive risky assets, the crypto-currency market is looking pale. Bitcoin aficionados will have to remain patient, once again, before seeing blue skies in the cryptosphere again. Timeline. The United States will go into daylight saving time this weekend, a fortnight before Europe. The hours of recurring statistics are advanced by one hour. The big event this week is the February inflation figures in the United States on Tuesday, along with a flurry of US statistics: producer prices, retail sales and the Empire State index. On Thursday, back to Europe with a monetary policy decision by the ECB, probably a hike in the refinancing rate from 3 to 3.50%. On Friday, another foray into the United States with February's industrial production and the University of Michigan's March consumer confidence index. |

|

|