Summary

Graphite spot prices - Prices are stable and recently rising slightly.

Graphite supply and demand - Demand is set to boom.

Top 3 graphite miners discussed and 2 speculative graphite picks.

I wrote previously about the graphite miners back in May 2016, which you can read here. This time I intend to give investors an update on the sector, and my current top 3 graphite miners. I chose to write about this sector as it should be a beneficiary of the electric vehicle (EV), and energy storage boom, as lithium ion battery demand surges.

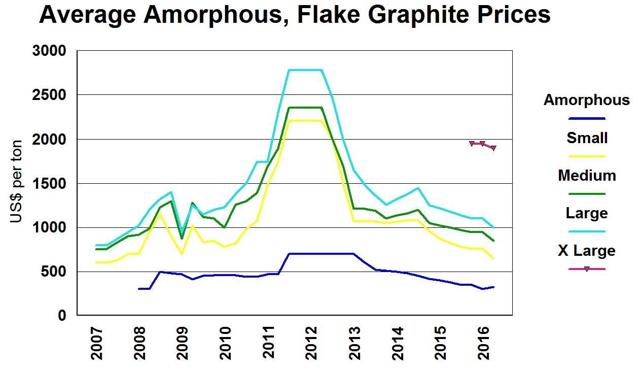

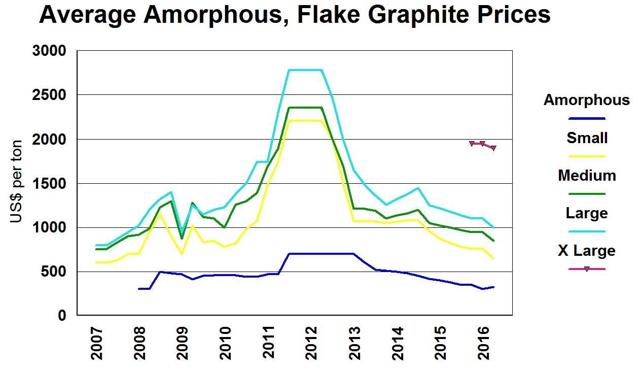

Graphite spot prices

Whilst 2016 saw large increases in lithium and cobalt prices, spot flake graphite prices have not yet reacted very much. You can view the current graphite spot price movements here. I am not expecting huge price rises in graphite as supply can ramp fairly quickly to match supply; however spherical graphite should continue to sell at a significant premium, as it is used in the lithium ion battery. Uncoated spherical sells for US$3-4,500/t, and coated spherical sells for US7-10,000/t, so significantly higher than large/jumbo flake graphite around US$1,000/t. Production costs are higher to produce spherical graphite and tend to be around 2,300-3,200/t.

Graphite flake price history

Source

Graphite demand and supply

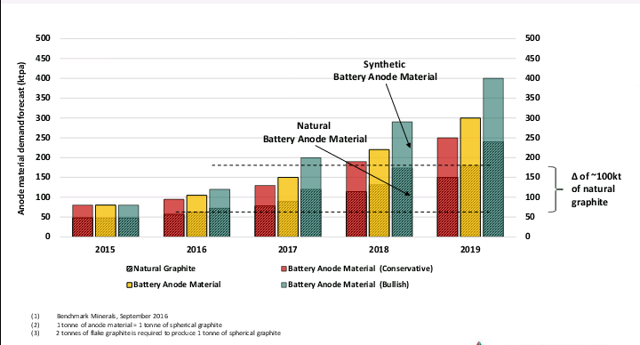

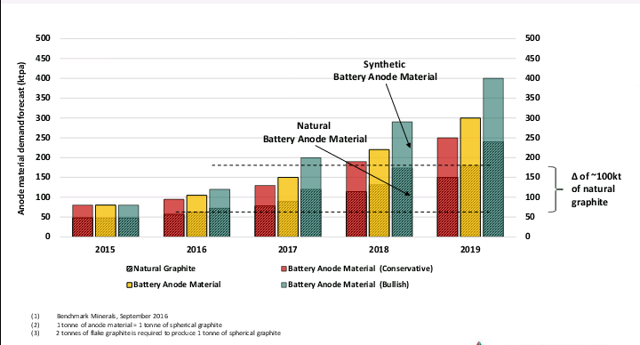

Graphite demand is forecast to be very strong in the next 5 years. Benchmark Mineral Intelligence forecasts "the anode market - which is nearly exclusively served by naturally sourced spherical graphite and synthetically produced graphite - to increase from 80,000 tpa in 2015 to at least 250,000 tpa by the end of 2020, while the market could be as large as 400,000 tpa in the most bullish of cases with no supply restrictions." Note, at least 70% of all battery anode material is sourced from natural spherical graphite, 30% from synthetic graphite material (which is more expensive). Flake graphite is the feedstock source for spherical graphite. In December 2016, China announced they plan to stockpile graphite as one of the critical elements.

Battery Anode graphite demand forecast to triple by 2020

Source: Syrah Resources New York Investor presentation - Page 22 - December 2016

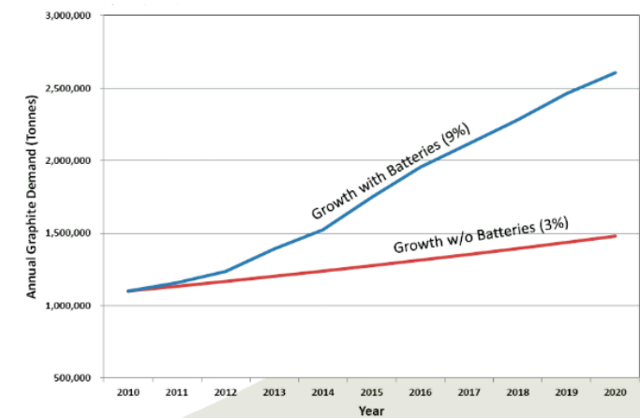

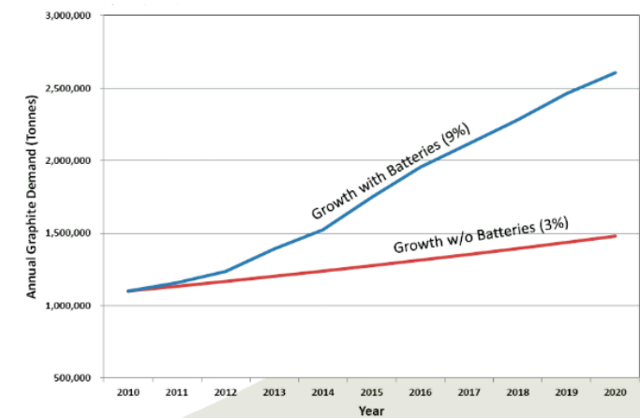

The above graph shows just "graphite battery anode" demand forecast to grow about 100,000 tonne pa. The graph below shows the whole graphite sector forecast demand to grow by around 200,000 tonne pa.

Graphite demand graph - 2010-2020

Source: Mason Graphite presentation - December 2016 - Page 9

Graphite supply should be able to keep up with the 200,000 tonne pa demand growth provided new projects can come online fairly quickly and as planned.

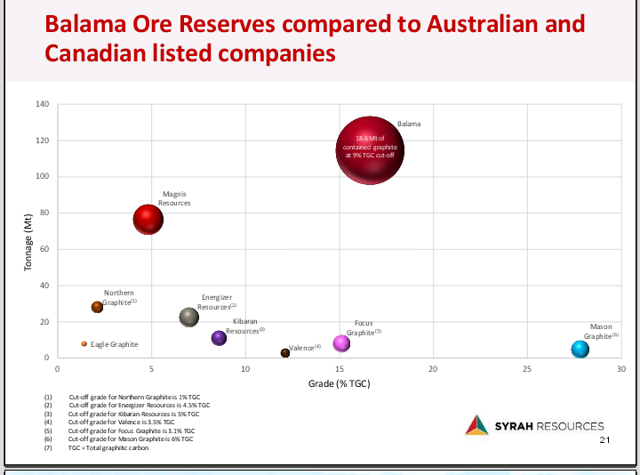

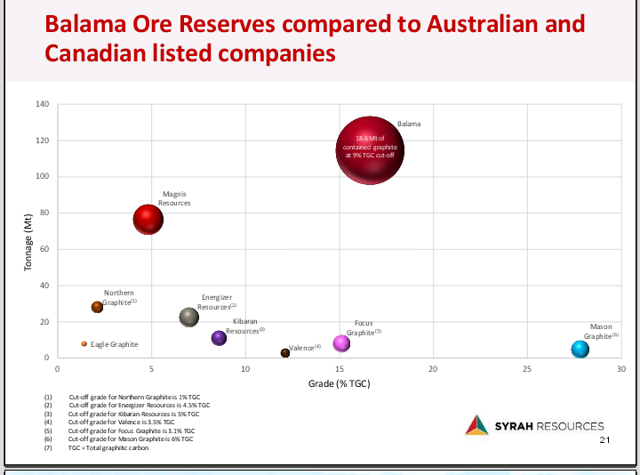

Graphite Miners comparison based on resource size and grade

Source: Syrah Resources New York Investor presentation - Page 23- December 2016

My top 3 graphite miners

1) Syrah Resources Limited (OTCPK:SYAAF) (ASX:SYR) - Price = USD 2.50, AUD 3.34

Syrah is currently my number one pick in this sector. As you can see from the graph above (largest red circle) they have by far the largest graphite resource (114.5 Mt at 16.6% TGC for 18.6 Mt of contained flake graphite) at their Balama mine in Mozambique, and the second highest grade. Their Feasibility Study (FS) results included an impressive IRR of 71%, post-tax NPV10 of US$1.1 billion. They will have one of the industry lowest costs of production (US$286/t per tonne FOB) and at least a 40 year mine life. They are also fully funded to reach production by mid 2017, with construction well underway. Syrah has off take agreements with Chalieco for 80 ktpa for three years, and with Marubeni for 50,000 tonnes of (spherical) graphite per annum for three years.

Syrah's market cap is AUD 881m or USD 643m. My model forecast price target for end 2017 is AUD 4.92 based on 150ktpa graphite production, and end 2018 target is AUD 6.82 based on 250ktpa. Analysts' consensus 1 year target is AUD 5.59. There is some skepticism in the market that Syrah can sell their targeted 356ktpa which is a valid concern right now; however by 2020 it should not be a problem if EV sales have ramped to 8-10% of vehicle sales, and energy storage is doing well. Also Syrah plans to sell 1/3 of the graphite to the industrial sector, and 2/3 to the lithium ion battery sector. As I explained earlier graphite demand should grow by around 200ktpa each year between now and 2020, and Syrah will likely catch a good part of that. Syrah also is planning a spherical graphite processing plant in the USA. This will allow Syrah to increase gross profit margin significantly.

You can read my latest article on Syrah Resources here.

Syrah Resources financials graph

Source:4-Traders

2) Mason Graphite (OTCQX:MGPHF) (TSXV:LLG) - Price = USD 1.02, CAD 1.35

Mason Graphite is my number two pick based on their very high grade (the highest by far in the chart above), and estimated very low costs. Their Lac Guéret graphite project is located in northeastern Québec, so low sovereign risk. Their resource is of average size, with a total indicated resource of 4.tMt @ 27.8% graphite, and inferred in-pit 58.1Mt grading 16.3% graphite, yielding a total of 10.57 Mt in situ graphite, and a 25 year + mine life.

Their 2015 FS resulted in a post-tax IRR of 34%, post-tax NPV8 of CAD 352m. CapEx is CAD 161m, and cash on hand was CAD 28.1m as of end September 2016. Mine construction began in September 2016, and production is planned to commence early 2018, assuming they can raise the funds successfully.

Their forecast cost of production is CAD376/t (US$282/t), so near the industry lower end. They plan to produce 51.9ktpa of graphite. The company intends to enter the value-added market, including spherical graphite for lithium ion batteries, and has undertaken the necessary feasibility study.

Investors can view the company's December 2016 presentation here.

The stock is up 275% in the past year, and currently has a market cap of CAD 154m. Back in May 2016 in my graphite miners article I rated them "definitely one of the best", when they were trading at CAD 0.62. I still rate them one of the best, and my end 2018 target price is CAD 1.93. Analyst consensus 1 year target is for CAD 2.13.

Mason Graphite financials graph

Source:4-Traders

3) Kibaran Resources (KBBRF)(ASX:KNL) - Price = AUD 0.18

Kibaran Resources are a reasonably valued lower market cap near term producer. Their projects include Epanko Graphite, Merelani-Arusha Graphite, Tanga Graphite, and Kagera Nickel. Their flagship Epanko graphite deposit in Southern Tanzania has a 25-year projected mine life with a reserve of 10.9Mt @ 8.6% TGC, for 0.94Mt contained graphite (with a good percentage of large flakes). The current indicated and referred resource is 23.3mt @9.4%, with upside exploration potential.

Their FS based on graphite production of 40ktpa reported a IRR of 41.2%, and a NPV of US$197.4m. They are in the later stages with off take agreements for over 40ktpa (20ktpa with ThyssenKrupp and 10ktpa to a German trader, 14ktpa+ with Sojitz Corporation). Sojitz is currently the largest supplier of raw battery materials (graphite and lithium), with ~60% market share and key downstream partners including LG, Panasonic and Samsung.

Initial mine CapEx of USD 77m, will mostly be debt funded, and production is planned to begin late 2017 after a 9 month stage one construction, assuming funding is successfully completed soon.

Kibaran plan to only upgrade production to 60ktpa once they have signed binding off take agreements. Production costs are estimated at USD 570/t FOB. The stock is reasonable value still with a market cap of AUD 45m. Based on 40ktpa production in 2018 my model target price is AUD 0.27, and based on 50ktpa production in 2019 a target of 0.35. I have assumed graphite selling price for all the graphite miners of just US$1,000/t to be cautious. Analyst targets are AUD 0.55, and 0.45, however they are using higher graphite selling prices around US$1,480/t.

Note: Focus Graphite (OTCQX:FCSMF) with a 15% graphite grade, and CAD 13m market cap would also be a strong third choice, just a bit more speculative with the stock trading at just CAD 0.08.

Speculative pick - Zenyatta Ventures (OTCQX:ZENYF) (NYSE:ZEN) - Price = USD 0.66, CAD 0.91

Zenyatta is currently developing the Albany Graphite deposit in Thunder Bay, Ontario, Canada. I like them as they have a unique type of graphite, and they are targeting the higher priced spherical graphite used in the lithium ion battery market.

Their resource size is indicated 25.1Mt @ 3.89% graphite, and inferred 20.1Mt @2.2% graphite, yielding 1.418Mt graphite.

The Albany deposit is a rare (hydrothermal) graphite deposit; this high crystallinity graphite can be upgraded without the use of aggressive acid (HF) or high temperature thermal treatment. They plan to produce an estimated annual production of 30,000 tonnes of high-quality graphite, with an operating cost of $2,046 per tonne. Higher upfront CapEx is a risk factor for them. The higher cost of production (relative to the flake graphite miners) is considered ok as they will be selling into the higher priced spherical graphite market. The potential upside comes from the very high margins in selling spherical graphite. At a market cap of just CAD 55m, they offer a higher risk, high reward option.

Risks for all the graphite miners

Sovereign and political risks.

Permitting and licensing issues, as well as royalties or tax issues.

Construction and production ramp up risks with a new project.

Project financing risk, and stock dilution risks.

Oversupply of graphite is perhaps the main risk, especially if Syrah Resources floods the market too quickly.

Very competitive sector as graphite is plentiful.

Graphite may be substituted with silicon for the battery anode. Possible, but not looking likely for now.

Liquidity risk - Best to buy on local exchanges.

Other competitors

The main competitors are Graphite One Resources Inc. (OTCQX:GPHOF) (GPH), Alabama Graphite (OTCQX:ABGPF) (TSXV:ALP), Energizer Resources (OTCQB:ENZR) (TSXV:EGZ), Focus Graphite (OTCQB:FCSMF) (NYSE:FMS), Magnis Resources (OTC:URNXF) (ASX:MNS), Talga Resources (ASX:TLG), AMG Advanced Metallurgical (OTCPK:AMVMF), Northern Graphite Corp. (OTCQX:NGPHF) (TSXV:NGC), Canada Carbon (OTC:BRUZF) [TSXV:CCB], Canada Strategic Metals (OTCPK:CJCFF) [TSXV:CJC], Caribou King Resources [TSXV:CKR], Great Lakes Graphite (OTCPK:GLKIF) [TSXV:GLK], Lomiko Metals (OTCQX:LMRMF) [TSXV:LMR], IMX Resources (OTCPK:GSMGF) [ASX:IXR], Graphex Mining (NYSE:GPX), Next Graphite (OTCPK:GPNE), Nouveau Monde Mining Enterprises (TSXV:NOU) (OTCPK:NMGRF), Eagle Graphite (OTC:APMFD) [TSXV:EGA], Flinders Resources (FLNXF) [TSXV:FDR], and StratMin Global Resources [LSE:STGR].

Conclusion

Graphite demand is very likely to surge in the next few years on the back of the lithium ion battery boom to supply electronic goods, electric vehicles, and energy storage. However, supply is also ramping up rapidly and should be able to meet this demand so graphite prices are unlikely to see the spectacular rises that lithium saw, and cobalt is currently experiencing. This will mean choosing the low cost producer will be important. Some people are concerned of oversupply by Syrah's large production plans; however I think this is not a great concern as global graphite demand is growing at around 200ktpa.

My top 3 graphite miners are Syrah Resources, Mason Graphite, and Kibaran Resources. My speculative picks are Zenyatta Ventures and Focus Graphite.

As usual all comments are welcome.

Disclosure: I am/we are long SYRAH RESOURCES (ASX:SYR), KIBARAN RESOURCES (ASX:KNL).

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as financial advice.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Graphite spot prices - Prices are stable and recently rising slightly.

Graphite supply and demand - Demand is set to boom.

Top 3 graphite miners discussed and 2 speculative graphite picks.

I wrote previously about the graphite miners back in May 2016, which you can read here. This time I intend to give investors an update on the sector, and my current top 3 graphite miners. I chose to write about this sector as it should be a beneficiary of the electric vehicle (EV), and energy storage boom, as lithium ion battery demand surges.

Graphite spot prices

Whilst 2016 saw large increases in lithium and cobalt prices, spot flake graphite prices have not yet reacted very much. You can view the current graphite spot price movements here. I am not expecting huge price rises in graphite as supply can ramp fairly quickly to match supply; however spherical graphite should continue to sell at a significant premium, as it is used in the lithium ion battery. Uncoated spherical sells for US$3-4,500/t, and coated spherical sells for US7-10,000/t, so significantly higher than large/jumbo flake graphite around US$1,000/t. Production costs are higher to produce spherical graphite and tend to be around 2,300-3,200/t.

Graphite flake price history

Source

Graphite demand and supply

Graphite demand is forecast to be very strong in the next 5 years. Benchmark Mineral Intelligence forecasts "the anode market - which is nearly exclusively served by naturally sourced spherical graphite and synthetically produced graphite - to increase from 80,000 tpa in 2015 to at least 250,000 tpa by the end of 2020, while the market could be as large as 400,000 tpa in the most bullish of cases with no supply restrictions." Note, at least 70% of all battery anode material is sourced from natural spherical graphite, 30% from synthetic graphite material (which is more expensive). Flake graphite is the feedstock source for spherical graphite. In December 2016, China announced they plan to stockpile graphite as one of the critical elements.

Battery Anode graphite demand forecast to triple by 2020

Source: Syrah Resources New York Investor presentation - Page 22 - December 2016

The above graph shows just "graphite battery anode" demand forecast to grow about 100,000 tonne pa. The graph below shows the whole graphite sector forecast demand to grow by around 200,000 tonne pa.

Graphite demand graph - 2010-2020

Source: Mason Graphite presentation - December 2016 - Page 9

Graphite supply should be able to keep up with the 200,000 tonne pa demand growth provided new projects can come online fairly quickly and as planned.

Graphite Miners comparison based on resource size and grade

Source: Syrah Resources New York Investor presentation - Page 23- December 2016

My top 3 graphite miners

1) Syrah Resources Limited (OTCPK:SYAAF) (ASX:SYR) - Price = USD 2.50, AUD 3.34

Syrah is currently my number one pick in this sector. As you can see from the graph above (largest red circle) they have by far the largest graphite resource (114.5 Mt at 16.6% TGC for 18.6 Mt of contained flake graphite) at their Balama mine in Mozambique, and the second highest grade. Their Feasibility Study (FS) results included an impressive IRR of 71%, post-tax NPV10 of US$1.1 billion. They will have one of the industry lowest costs of production (US$286/t per tonne FOB) and at least a 40 year mine life. They are also fully funded to reach production by mid 2017, with construction well underway. Syrah has off take agreements with Chalieco for 80 ktpa for three years, and with Marubeni for 50,000 tonnes of (spherical) graphite per annum for three years.

Syrah's market cap is AUD 881m or USD 643m. My model forecast price target for end 2017 is AUD 4.92 based on 150ktpa graphite production, and end 2018 target is AUD 6.82 based on 250ktpa. Analysts' consensus 1 year target is AUD 5.59. There is some skepticism in the market that Syrah can sell their targeted 356ktpa which is a valid concern right now; however by 2020 it should not be a problem if EV sales have ramped to 8-10% of vehicle sales, and energy storage is doing well. Also Syrah plans to sell 1/3 of the graphite to the industrial sector, and 2/3 to the lithium ion battery sector. As I explained earlier graphite demand should grow by around 200ktpa each year between now and 2020, and Syrah will likely catch a good part of that. Syrah also is planning a spherical graphite processing plant in the USA. This will allow Syrah to increase gross profit margin significantly.

You can read my latest article on Syrah Resources here.

Syrah Resources financials graph

Source:4-Traders

2) Mason Graphite (OTCQX:MGPHF) (TSXV:LLG) - Price = USD 1.02, CAD 1.35

Mason Graphite is my number two pick based on their very high grade (the highest by far in the chart above), and estimated very low costs. Their Lac Guéret graphite project is located in northeastern Québec, so low sovereign risk. Their resource is of average size, with a total indicated resource of 4.tMt @ 27.8% graphite, and inferred in-pit 58.1Mt grading 16.3% graphite, yielding a total of 10.57 Mt in situ graphite, and a 25 year + mine life.

Their 2015 FS resulted in a post-tax IRR of 34%, post-tax NPV8 of CAD 352m. CapEx is CAD 161m, and cash on hand was CAD 28.1m as of end September 2016. Mine construction began in September 2016, and production is planned to commence early 2018, assuming they can raise the funds successfully.

Their forecast cost of production is CAD376/t (US$282/t), so near the industry lower end. They plan to produce 51.9ktpa of graphite. The company intends to enter the value-added market, including spherical graphite for lithium ion batteries, and has undertaken the necessary feasibility study.

Investors can view the company's December 2016 presentation here.

The stock is up 275% in the past year, and currently has a market cap of CAD 154m. Back in May 2016 in my graphite miners article I rated them "definitely one of the best", when they were trading at CAD 0.62. I still rate them one of the best, and my end 2018 target price is CAD 1.93. Analyst consensus 1 year target is for CAD 2.13.

Mason Graphite financials graph

Source:4-Traders

3) Kibaran Resources (KBBRF)(ASX:KNL) - Price = AUD 0.18

Kibaran Resources are a reasonably valued lower market cap near term producer. Their projects include Epanko Graphite, Merelani-Arusha Graphite, Tanga Graphite, and Kagera Nickel. Their flagship Epanko graphite deposit in Southern Tanzania has a 25-year projected mine life with a reserve of 10.9Mt @ 8.6% TGC, for 0.94Mt contained graphite (with a good percentage of large flakes). The current indicated and referred resource is 23.3mt @9.4%, with upside exploration potential.

Their FS based on graphite production of 40ktpa reported a IRR of 41.2%, and a NPV of US$197.4m. They are in the later stages with off take agreements for over 40ktpa (20ktpa with ThyssenKrupp and 10ktpa to a German trader, 14ktpa+ with Sojitz Corporation). Sojitz is currently the largest supplier of raw battery materials (graphite and lithium), with ~60% market share and key downstream partners including LG, Panasonic and Samsung.

Initial mine CapEx of USD 77m, will mostly be debt funded, and production is planned to begin late 2017 after a 9 month stage one construction, assuming funding is successfully completed soon.

Kibaran plan to only upgrade production to 60ktpa once they have signed binding off take agreements. Production costs are estimated at USD 570/t FOB. The stock is reasonable value still with a market cap of AUD 45m. Based on 40ktpa production in 2018 my model target price is AUD 0.27, and based on 50ktpa production in 2019 a target of 0.35. I have assumed graphite selling price for all the graphite miners of just US$1,000/t to be cautious. Analyst targets are AUD 0.55, and 0.45, however they are using higher graphite selling prices around US$1,480/t.

Note: Focus Graphite (OTCQX:FCSMF) with a 15% graphite grade, and CAD 13m market cap would also be a strong third choice, just a bit more speculative with the stock trading at just CAD 0.08.

Speculative pick - Zenyatta Ventures (OTCQX:ZENYF) (NYSE:ZEN) - Price = USD 0.66, CAD 0.91

Zenyatta is currently developing the Albany Graphite deposit in Thunder Bay, Ontario, Canada. I like them as they have a unique type of graphite, and they are targeting the higher priced spherical graphite used in the lithium ion battery market.

Their resource size is indicated 25.1Mt @ 3.89% graphite, and inferred 20.1Mt @2.2% graphite, yielding 1.418Mt graphite.

The Albany deposit is a rare (hydrothermal) graphite deposit; this high crystallinity graphite can be upgraded without the use of aggressive acid (HF) or high temperature thermal treatment. They plan to produce an estimated annual production of 30,000 tonnes of high-quality graphite, with an operating cost of $2,046 per tonne. Higher upfront CapEx is a risk factor for them. The higher cost of production (relative to the flake graphite miners) is considered ok as they will be selling into the higher priced spherical graphite market. The potential upside comes from the very high margins in selling spherical graphite. At a market cap of just CAD 55m, they offer a higher risk, high reward option.

Risks for all the graphite miners

Sovereign and political risks.

Permitting and licensing issues, as well as royalties or tax issues.

Construction and production ramp up risks with a new project.

Project financing risk, and stock dilution risks.

Oversupply of graphite is perhaps the main risk, especially if Syrah Resources floods the market too quickly.

Very competitive sector as graphite is plentiful.

Graphite may be substituted with silicon for the battery anode. Possible, but not looking likely for now.

Liquidity risk - Best to buy on local exchanges.

Other competitors

The main competitors are Graphite One Resources Inc. (OTCQX:GPHOF) (GPH), Alabama Graphite (OTCQX:ABGPF) (TSXV:ALP), Energizer Resources (OTCQB:ENZR) (TSXV:EGZ), Focus Graphite (OTCQB:FCSMF) (NYSE:FMS), Magnis Resources (OTC:URNXF) (ASX:MNS), Talga Resources (ASX:TLG), AMG Advanced Metallurgical (OTCPK:AMVMF), Northern Graphite Corp. (OTCQX:NGPHF) (TSXV:NGC), Canada Carbon (OTC:BRUZF) [TSXV:CCB], Canada Strategic Metals (OTCPK:CJCFF) [TSXV:CJC], Caribou King Resources [TSXV:CKR], Great Lakes Graphite (OTCPK:GLKIF) [TSXV:GLK], Lomiko Metals (OTCQX:LMRMF) [TSXV:LMR], IMX Resources (OTCPK:GSMGF) [ASX:IXR], Graphex Mining (NYSE:GPX), Next Graphite (OTCPK:GPNE), Nouveau Monde Mining Enterprises (TSXV:NOU) (OTCPK:NMGRF), Eagle Graphite (OTC:APMFD) [TSXV:EGA], Flinders Resources (FLNXF) [TSXV:FDR], and StratMin Global Resources [LSE:STGR].

Conclusion

Graphite demand is very likely to surge in the next few years on the back of the lithium ion battery boom to supply electronic goods, electric vehicles, and energy storage. However, supply is also ramping up rapidly and should be able to meet this demand so graphite prices are unlikely to see the spectacular rises that lithium saw, and cobalt is currently experiencing. This will mean choosing the low cost producer will be important. Some people are concerned of oversupply by Syrah's large production plans; however I think this is not a great concern as global graphite demand is growing at around 200ktpa.

My top 3 graphite miners are Syrah Resources, Mason Graphite, and Kibaran Resources. My speculative picks are Zenyatta Ventures and Focus Graphite.

As usual all comments are welcome.

Disclosure: I am/we are long SYRAH RESOURCES (ASX:SYR), KIBARAN RESOURCES (ASX:KNL).

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as financial advice.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.