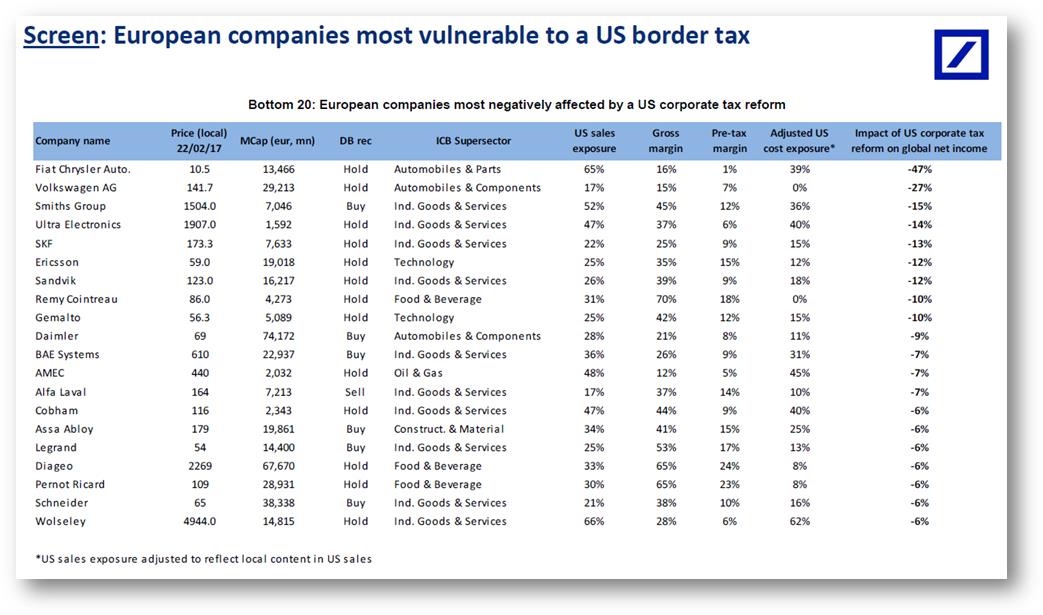

European car manufacturers including Fiat Chrysler, Volkswagen and Daimler are likely to be the biggest losers from the new U.S. administration's controversial border tax proposals, new research from Deutsche Bank suggests.

Analysis of the European stocks set to be most impacted by plans to impose new tariffs on imports into the U.S. suggests that the 70 Stoxx 600 companies with greatest exposure to the U.S. could see their profits fall by around 5 percent.

President Trump has recently pledged "lowering the overall tax burden on American businesses, big league." Based on his campaign rhetoric and proposals put forward by the House of Representatives Republicans, this could involve a significant reduction in U.S. statutory corporate tax, with proposals suggesting cutting this from 35 percent to 20 percent. However it could also lead to the introduction of a U.S. border tax adjustment, which will negatively impact overseas businesses with sizable U.S. sales and low U.S. production.

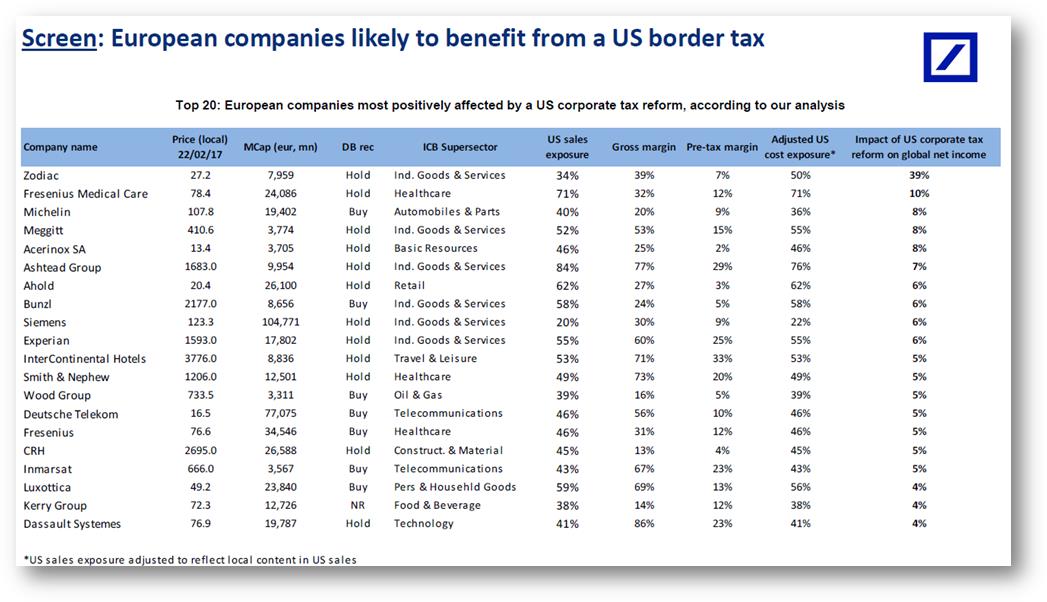

"European companies with sizable US sales, low US production volumes and low margins are the most vulnerable, while companies with sizable US sales and low US imports (either due to local production or as they are service providers) are likely net beneficiaries," the bank said in a research note.

European auto companies will see the greatest hit from such proposals, according to Deutsche Bank. Its estimates suggest that the auto firms with greatest U.S. exposure could see a 16 percent fall in earnings per share (EPS), while the sector overall would likely fall 10 percent.

Fiat Chrysler, the manufacturer with greatest U.S. sales exposure, would face the biggest hit, it claims, estimating a 47 percent fall in global net income. This is based on the "direct and static" impact of the proposed reforms and excluding the ability for companies to pass on costs. Volkswagen and Daimler could see global net income fall by 27 percent and 9 percent respectively.

The technology and healthcare equipment sectors are also set to be largely impacted by the reforms, notes the research, however, the impact on individual stocks is likely to vary drastically, resulting in a more muted impact for the sector as a whole.

Deutsche Bank pinpoints technology firms Ericsson and Gemalto among the biggest losers.

Industry goods and services firms Smiths Group, Ultra Electronics and SKF could also suffer significantly, it said.

Conversely, sectors with sizeable U.S. sales and low U.S. imports are more likely to fare well from the changes. These look set to include construction materials and food retail, with Deutsche Bank naming CRH and Kerry Group among the potential strongest performers.

The bank noted that its estimates on the potential impact of U.S. tax reforms on European earnings remains "tentative" ahead of further announcements from the new U.S. administration.