| The week ended on a bearish note, although the Fed's decision seemed to be well received on Wednesday. Financial markets are finally losing ground in the wake of technology stocks, which are more sensitive to the economic situation and the cost of money. Despite the approaching holiday season, volatility could persist due to the pandemic, after an exceptional year in 2020. |

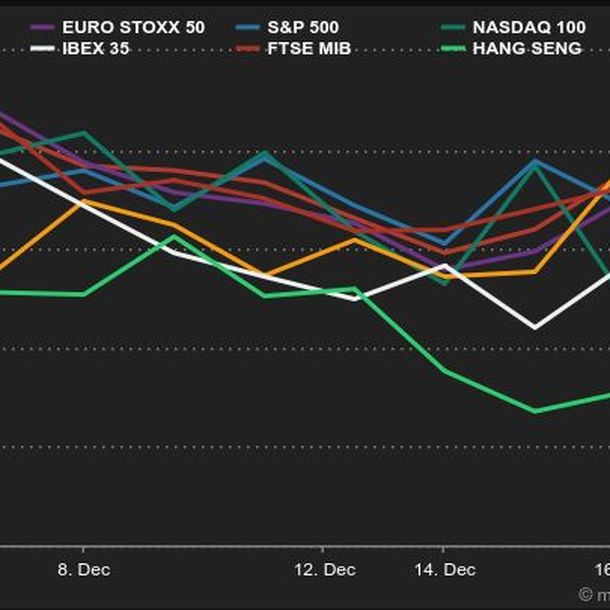

| Indexes Over the past week, in Asia, the Nikkei gained 0.4% while the Shanghai Composite lost 0.9% and the Hang Seng 3.2%. In Europe, red is also dominant. The CAC40, which has so far achieved the best annual performance, lost 0.93% over the last five days. The Dax is down 0.59% and the Footsie 0.3%. For the peripheral countries of the euro zone, Portugal lost 1.4% over the week, Spain 0.8% and Italy 1.2%. At the time of writing, the Nasdaq100 was the worst performer in the US (-3.3%). The S&P500 is down 1.50% and the Dow Jones is down 1.27%.  |

| Commodities Investors, who expected the Federal Reserve's more austere tone to be accompanied by a rally in the dollar and a decline in commodities were left with a sore spot this week. On the contrary, the market relaxed after the Fed's clarification of its monetary policy, allowing oil prices to stabilize after an episode of volatility. OPEC has reiterated that it is ready to act if the situation requires an intervention, even if the cartel describes the impact of the Omicron variant as short-lived and ephemeral on global oil demand. Brent crude is trading around USD 73.5 a barrel while WTI is trading above USD 71. It was a near perfect end to the week for gold, which is back above the USD 1,800 per ounce line. The gold metal is benefiting from the fall of the greenback but also from an increase in volatility in the equity markets, where there are brief sequences of euphoria and confusion. Silver is also recovering and is trading above USD 22. Base metals ended the week in mixed order. Zinc and lead rose slightly to USD 3395 and USD 2355, while nickel and tin posted negative weekly performances at USD 19580 and USD 38700 per metric ton. |

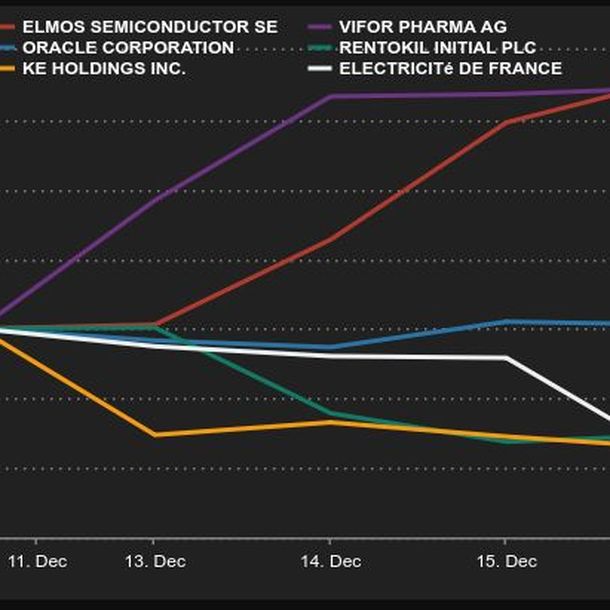

| Equity markets - Elmos Semiconductor (+33%): The stock surged this week after the announcement of the sale of a manufacturing plant in Dortmund to Silex Microsystems for €85 million. Analysts were very positive about the news. - Vifor Pharma (+30%): the Australian biotech group will make a friendly offer to buy its Swiss counterpart for CHF 10.9bn. The proposal, denominated in dollars, corresponds to about CHF 167 per share. The main shareholder of the St. Gallen-based group, with a 23.2% stake, supports the project. - Oracle (+16%): the share price jumped on Monday after very convincing quarterly results and the strengthening of its share buyback program. On Thursday evening, a rumor began to circulate about an interest in the healthcare publisher Cerner, which could be valued at $30 billion. - Rentokil (-17%): the market is cautiously welcoming the acquisition of American company Terminix for $6.7 billion. The transaction will be paid for $1.3 billion in cash and the balance in new Rentokil shares, causing a high dilution. Terminix is specialized in pest control. - KE Holdings (-20%): The New York-listed Chinese company is suffering severe write-offs after being mocked by the notorious bear fund Muddy Waters, which accused it of fraud. The company denied this. Muddy Waters believes that KE is artificially inflating its business. - Electricité de France (-20%): cold shower for shareholders, after a warning launched by the French nuclear energy giant. EDF discovered defects in a nuclear power plant and closed another plant using the same type of reactors, which led it to reduce its 2021 financial targets.  |

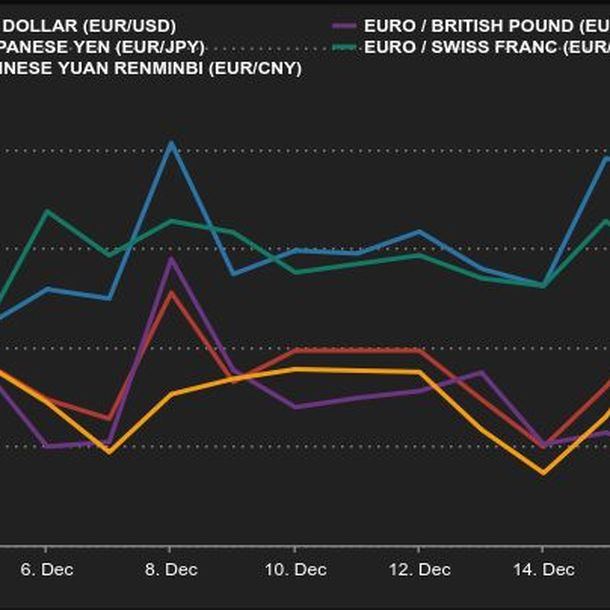

| Macroeconomics The main western central banks had scheduled a monetary policy meeting for the week of December 13-20, in order to spend the holiday season in peace. But don't think that the exercise was going to be easy, since they had to deal with a very complex equation made up of inflation, the floor rate, the coronavirus, overheated labour markets, global growth and so on. Jerome Powell explained that the US economy is strong enough to do without the asset purchase plan put in place to support the economy, which will end in March. At the same time, the Fed presented a precise schedule of rate hikes. There will be three in 2022, then three more in 2023 and finally two in 2024. The central bank is accelerating the pace to curb inflation. Last September, it was still thinking of only one rate hike next year. The initial reaction of markets was positive, but the next day, nervousness took over again, especially on the Nasdaq, where highly valued stocks are not happy about the prospect of less liquidity. At the same time, the Bank of England surprised the market by raising its key rates, while the Omicron variant is overwhelming the UK. The ECB, for its part, was content to maintain the status quo, although it announced the gradual end of its asset purchase program designed to counter the pandemic. However, in order not to disrupt the markets too much, the pre-existing repurchase program will be reinforced. These decisions did not cause any major movements in rates. Ten-year US debt is trading at around 1.4% and the Bund at -0.38%. The French OAT remains in slightly negative territory (-0.03%). In the foreign exchange market, the Turkish lira continues to break down against other currencies, notably the euro and the dollar. The Turkish central bank has again reduced its rates under pressure from President Erdogan, against the current of galloping inflation. The euro rose to USD 1.13143 despite the firmness of the US central bank. The EUR/CHF is trading at CHF 1.04135, while JPY 113.362 is needed for USD 1. The Bank of Japan, too, held a monetary policy meeting this week, without changing rates but scaling back its support plan for the economy. On the cryptocurrency market, the holiday season is looking less joyful than expected with a breakthrough into the red that is definitely having a hard time resorbing. A fall of more than 30% from the highs has come to cast doubt among market players regarding the bullish continuation yet well established since the beginning of the year. Bitcoin is not catching its breath either, coming dangerously close to $45,000 at the time of writing. Over the past week, November's manufacturing and services PMIs have lagged expectations, no doubt affected by the resurgence of the pandemic. In the coming days, the agenda will be much less busy, with Christmas approaching. However, investors will keep an eye on Wednesday's final reading of U.S. GDP for Q3 and especially on Thursday's PCE inflation and November durable goods orders in the United States.  |

| 2021 remains a good vintage This day of the four witches marks the end of the 2021 stock market year. If you are currently hesitating between seeing the glass as half full or half empty, let's try to keep in mind that this year will remain a very good vintage for investors. With the exception of some Asian indices, the world's stock markets are posting strong gains, with flattering scores for the S&P500 (+24.30%), the EuroStoxx50 (+18.2%) and the CAC40 (+26.2%). And if you're dreaming of a Christmas rally under the tree, then let's not lose sight of the fact that equity indices have given us record highs this year, that companies are achieving record margins and sales and that central bankers are bending over backwards to pave the way for financiers on their policy path. Finally, we may have had our Christmas early, which helps put the latest market volatility into perspective. Your weekly update will take a break for the holiday season, and resume on Friday, January 7. Merry Christmas and Happy New Year to all! |

© MarketScreener.com 2021