|

| This week's gainers and losers |

Gainers: John Wood (+38%): There's speculation on the British oil services group, which announced that it had received and rejected three consecutive offers from the Apollo Global fund. The last of these was for GBp 230. Rolls-Royce (+25%): Finally a turnaround for the aircraft engine manufacturer? Perhaps, after a barren spell. Investors appreciate it. Cheniere Energy (+12%): The oil group reported much better-than-expected results in the fourth quarter, which boosted its share price on Thursday. Nvidia (+10%): The American semiconductor group specializing in graphics cards has published more ambitious targets than expected, which has filled investors with joy. Losers: Unity Software (-25%): The video game development platform posted a larger-than-expected net loss in 2022. Early year forecasts are not great. Lucid Group (-25%): The 2023 forecast for production fell well short of analysts' expectations and the EV maker reported a major drop in orders during the fourth quarter amid weakening demand, sending the electric carmaker's shares down 11% after hours. Keysight Technology (-16%): The company, which specializes in the development and marketing of electronic design, test and measurement solutions and systems for electronic equipment and systems, issued a sales guidance for Q2 that lagged estimates. Euronext (-11%): The market has been punished by the announcement of a possible takeover of Allfunds, which will be partly in shares, leading to a dilution of shareholders. Basically, the transaction makes sense for the stock exchange operator, which is seeking to diversify its sources of revenue. |

|

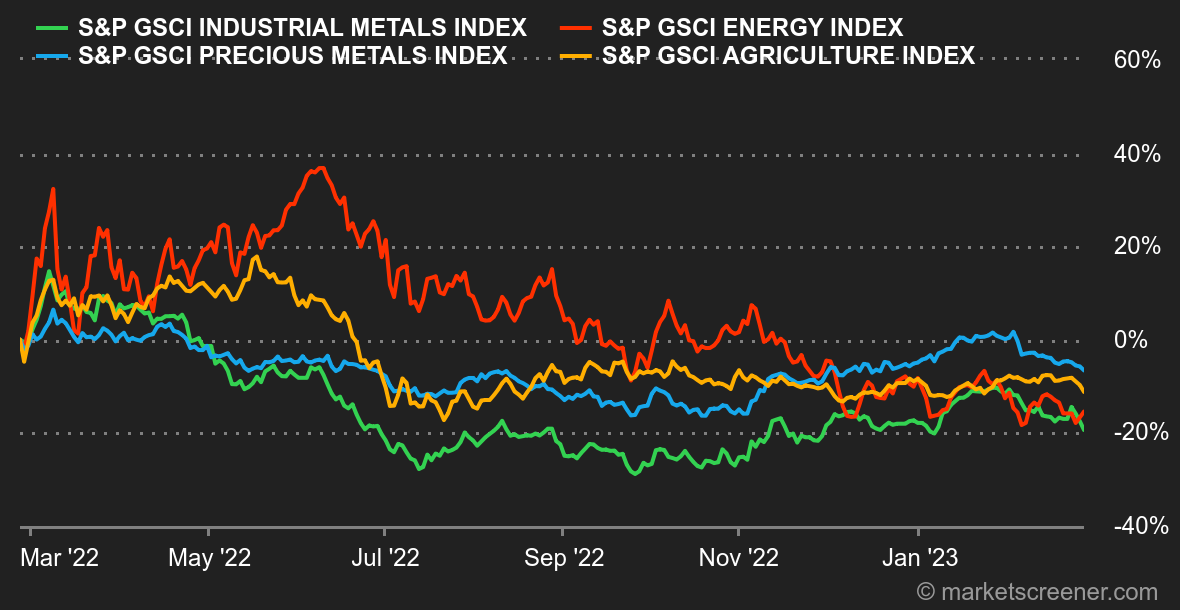

| Commodities |

| Energy: U.S. oil inventories have risen for the ninth consecutive week, a dynamic that weighs on oil prices, which fell this week, respectively at 82.50 and 76 dollars per barrel for European Brent and U.S. WTI. We can add that investors are still expecting a more hawkish Fed as the latest economic data suggest that the US economy is still going very (too) strong. This will penalize risk assets, including oil. In Europe, natural gas is stabilizing at around EUR 52/MWh for the Dutch benchmark. Metals: On the London Metal Exchange, the price of a ton of copper recovered to once again settle above USD 9,000. In major news this week, Canadian company First Quantum suspended operations at its Cobre Panama copper mine due to a dispute with the Panamanian government. The site is one of the largest mines in Central America and accounts for about 1.5% of global copper production. Other industrial metals, such as zinc, aluminum and lead, have stabilized over the past five days. In precious metals, the surge in bond yields is still weighing on short-term gold, which is down another week at USD 1820. Agricultural products: In its latest monthly report, the U.S. Department of Agriculture (USDA) expects a significant increase in corn production in the United States due to an increase in the area dedicated to this crop. This increase is of the order of 10% year-on-year. The increase is even more spectacular for wheat, whose national production is expected to jump by 14%, again for the same reasons. In Chicago, a bushel of wheat is trading down to 730 cents, as is a bushel of corn at 650 cents. |

|

| Macroeconomics |

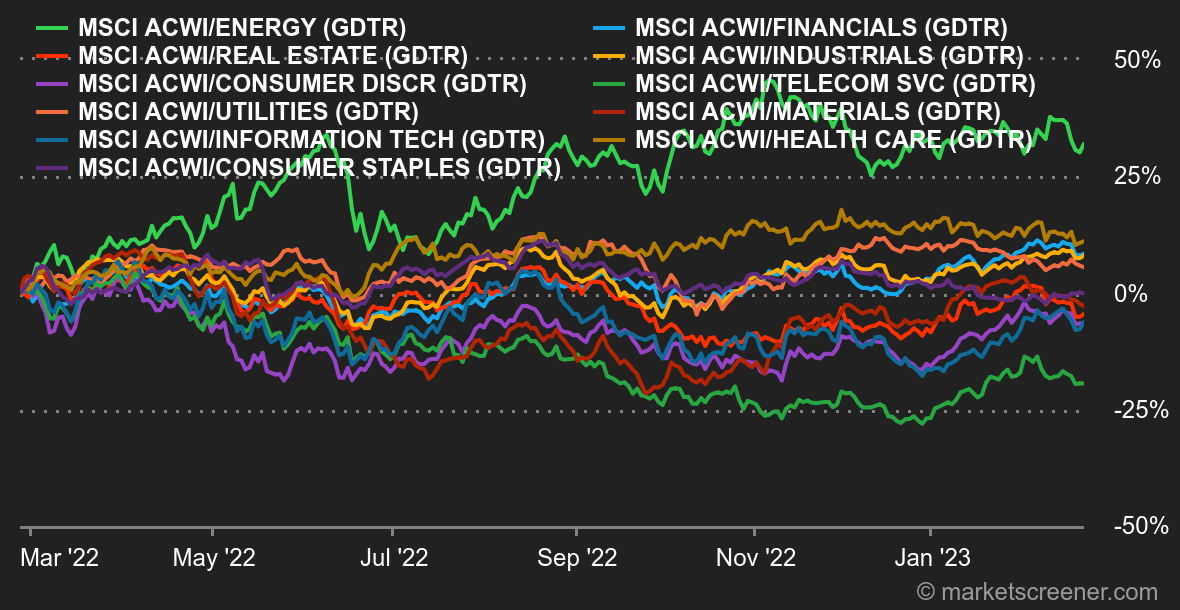

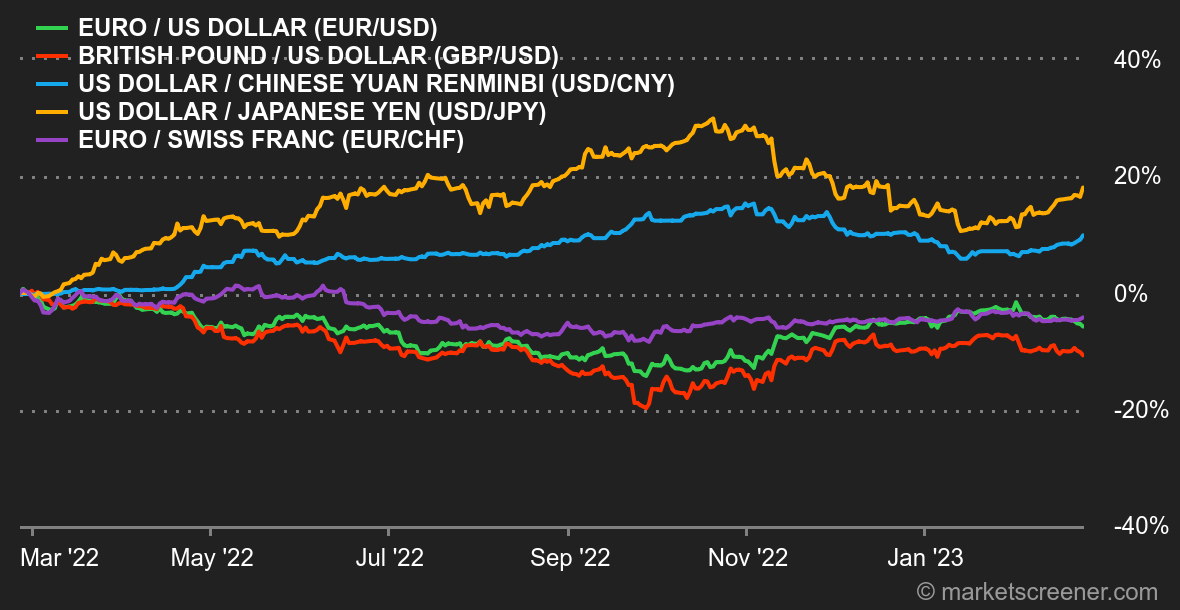

Atmosphere. It's a bit much. Has U.S. PCE inflation planted the fatal knife in the back of stock market bulls? The flow of macroeconomic news supporting a moderation of central bank rate hikes seems to be drying up. Several pieces of data in the US and Europe have reignited concerns about the trajectory of prices. Not enough to make investors pessimistic yet, but enough to worry them. There will be plenty of other indicators next week to form a more refined opinion. Currencies. The dollar continues to strengthen, especially after the announcement of higher than expected PCE inflation in January. The euro is back below $1.06. Earlier in the week, developments between G10 currencies remained within narrow bounds. The first hearing of Japan's future central bank governor, Kazuo Ueda, did not cause much of a stir in the USD/JPY pair, which finally shifted above JPY 136 per USD only after the announcement of PCE inflation. Rates. Investors did not wait for last Friday's figures to push up government bond yields throughout the week. One could even say that the reaction that followed the publication of a PCE annual increase of 5.4% against 5.00% was limited, at least on the long side (10 years and more). On the other hand, the US 2-year is now close to its March high of 4.80%. As a consequence, the 2/10 spread remains stubbornly inverted, a sign of a potentially gloomy future (the underperformance of the S&P 500 is a perfect illustration). As for the German Bund yield, no big change: it is only a few steps away from its resistance line in place since October, resistance at around 2.55% with 3.01% in sight in case of overflow. Cryptocurrencies. Bitcoin is down 2% this week and is back below $24,000 at the time of writing. Still waiting for strong positive catalysts, digital currencies are stalling in a macroeconomic environment that still doesn't check all the boxes to support risky assets. Clearly, the good news about cryptocurrency adoption is not enough to entice investors. The monetary policy pivot of central bankers is therefore expected like the messiah to give crypto-assets a boost. Agenda. The market will focus on a handful of key events next week. First the US durable goods orders (Monday), then the Conference Board's US consumer confidence index (Tuesday). The final ISM manufacturing indexes for February will be on Wednesday. The first estimate of Eurozone inflation in February will take over (Thursday). The week will end with the final February PMI indexes and the American counterpart, the ISM services index (Friday). |

|

|