Bank stocks have faced a reckoning over the past week following the collapse of Silicon Valley Bank SIVB and Signature Bank SBNY.

The understandable question in the minds of many investors and savers: Which other banks are at risk?

Answering that question requires understanding the nature of the current crisis, which in many ways is tied to the basics of banking: Banks take deposits and use them to fund loans and make investments. This brings up two issues: interest-rate risk and liquidity risk.

The risk around interest rates stems from the fact that higher interest rates cause prices on fixed-rate securities to drop. Over the past year, the Federal Reserve’s aggressive interest-rate hikes have inflicted big losses on bonds bought by these banks when rates were much lower.

The second key risk is liquidity risk. This is the risk that too many depositors withdraw their deposits all at once, also known as a “run” on the bank. Eventually, this reaches a point where the bank either can no longer pay out depositors immediately, or at the very least, its balance sheet structure no longer makes sense. The FDIC was created after the Great Depression for the primary purpose of stopping these bank runs before they begin

In the current crisis, the Fed has stepped in to provide a backstop to banks facing a significant misalignment on their balance sheets. While the Fed’s efforts could prevent more bank failures, using this backstop could come with a cost for those banks.

For investors, a critical step is understanding where banks fall on the spectrum of risks around liquidity.

In this article, we’ll break down banks covered by Morningstar into two broad buckets: those at greatest risk, such as First Republic Bank FRC and Truist Financial TFC; and safer names, such as JPMorgan Chase JPM and Citigroup C.

Of course, there are nuances to this assessment. Bank of America BAC falls somewhere in between, with both concerns about balance sheet liquidity and its status as a “too-big-to-fail” bank.

Understanding the Fed’s Backstop

On March 12, the Fed announced a new program on in which it would make both uninsured and insured deposits at SVB and Signature Bank whole. This meant that customers would be reimbursed for the entirety of their deposits at their banks should they fail, even if it exceeds the FDIC’s $250,000 limit.

The Fed also set up a liquidity facility for banks to help prevent additional bank closures by allowing them to take out loans to Fed by using their U.S. Treasuries as collateral. The Fed would value the Treasuries at par as opposed to market value, providing an avenue for banks to avoid selling Treasuries at their market value, which would have led to major realized losses due to aggressive rate hikes over the last year.

Those efforts were meant to reinforce confidence in bank clients by providing additional liquidity to banks to prevent further failures, as well as ensuring that clients would get reimbursed for the entirety of their deposits even in the event of a failure.

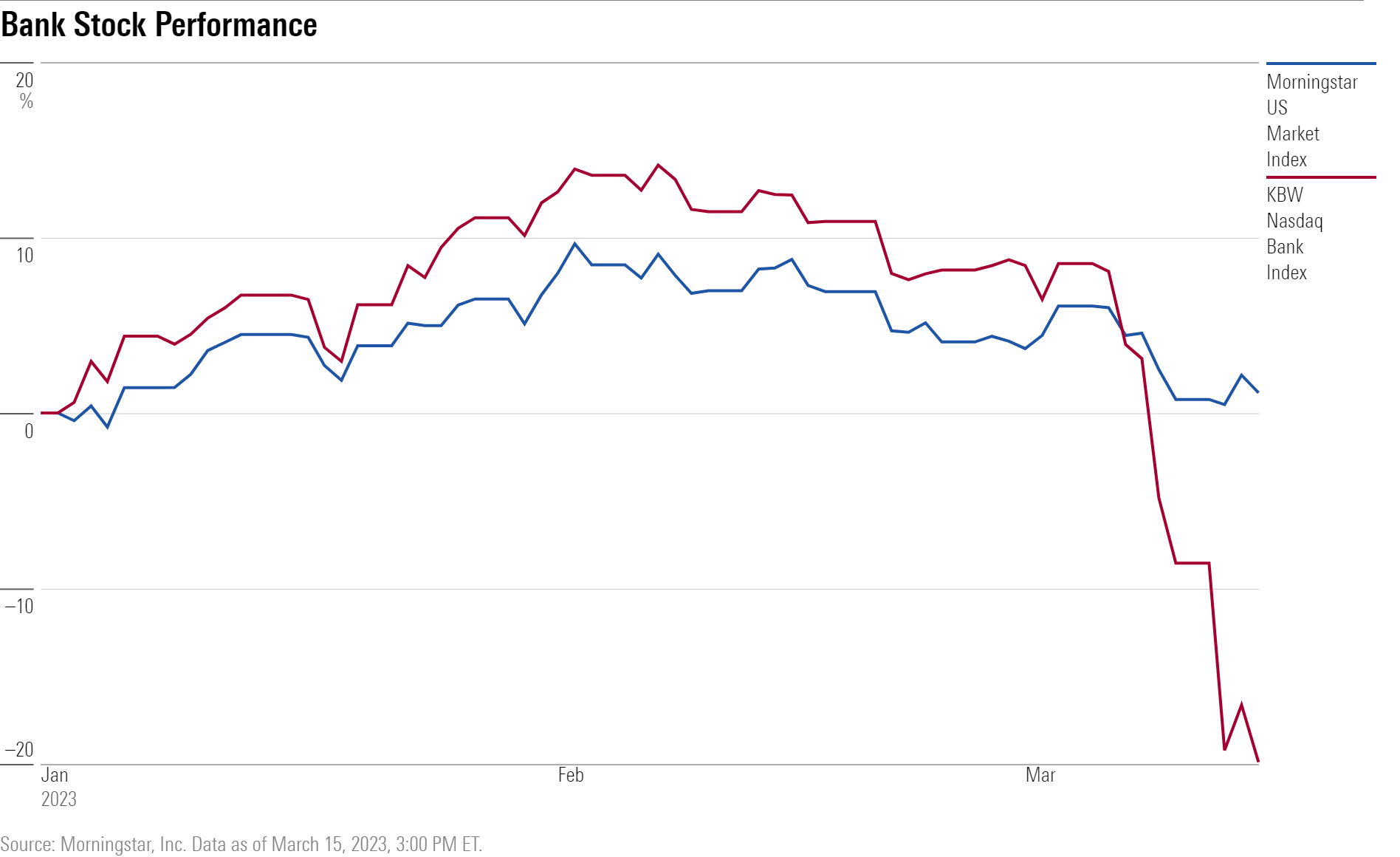

Those actions seemed to address some of the concerns. After a harrowing 11.7% loss for the KBW Nasdaq Bank Index on March 13, bank stocks jumped 3.2% the next day. However, the situation has yet to be defused, and investors sent bank stocks down again nearly 5% on March 15 as fresh troubles with Credit Suisse CS in Europe set off another wave of worries. The KBW is now down about 20% this year to date.

Which Bank Stocks Are Most at Risk?

In the wake of the collapse of Silicon Valley Bank and Signature Bank, the list of those most at risk is dominated by other regional banks. These stocks have also been hardest hit in the recent bank stock selloff, such as First Republic losing 51.3%, Comerica CMA falling 24.8%, and Zions Bancorporation ZION down 22.4% between March 13 and 14.

The fear surrounding those banks is centered around the possibility of clients pulling out their deposits en masse. Regional banks are typically not as liquid as their diversified counterparts. A significant-enough bank run would be sufficient to doom any bank, says Morningstar strategist Eric Compton. Furthermore, regionals tend to have less of a buffer than the largest banks.

The stock facing the biggest questions is First Republic Bank, which is down 67.4% for the year as of March 14.

First Republic’s issues are a bit idiosyncratic, with its liquidity issue being driven by a high loan-to-deposit ratio of 94%, compared with an average of 68% among banks covered by Compton. The bank is using nearly all its deposits to fund its lending activities, and Compton sees the bank as having both above-average liquidity and high capital risk.

Furthermore, Compton notes that First Republic’s clients may overlap with SVB’s clients, leading to speculation that customers may be uncomfortable with leaving their deposits at the bank and moving elsewhere given their potential proximity to SVB’s closure.

Couple this with the fact that, should First Republic end up closing, the bank would need to sell its loan book at market value, it would wipe out all value for equityholders, according to Compton.

In addition to First Republic Bank, these regional banks are also facing above-average liquidity and/or above-average capital risks:

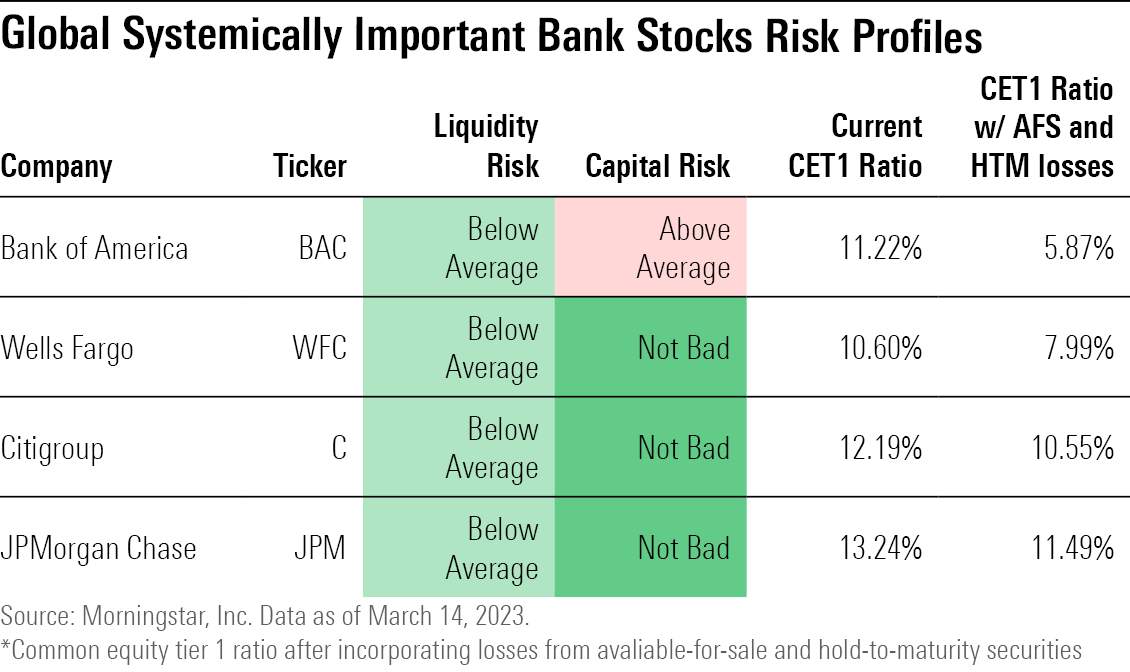

Compton sees these four banks as among those whose financial health would suffer the most should they have to realize the losses from their available-for-sale and hold-to-maturity securities. While those losses remain unrealized, these banks are in good standing based on their common equity Tier 1 Ratio, which is a measure regulators use to evaluate a bank’s ability to absorb losses without triggering insolvency.

Generally, banks want to aim toward a common equity Tier 1 ratio of 7% as a minimum, or face fines from regulators. Banks that go below 4.5% could trigger a takeover by regulators. Those four banks, plus First Republic, all currently have common equity Tier 1 ratios over the 7% minimum. However, if they’re forced to sell securities and realize their losses to raise liquidity, that quickly changes.

Compton calculates that half the 12 regional banks he covers would fall below 7%. Truist Financial would be worst off, as it would see its ratio fall to 5.03%, barely above the 4.5% that would put the bank in the hot seat with regulators.

Bank of America’s Risks

In addition to the above five regional banks, Compton also highlights Bank of America as a diversified bank that he sees as having an above-average capital risk. Should Bank of America have to realize the losses on its balance sheet, its common equity Tier 1 ratio would drop to 5.87% from 11.22% in that event.

However, banks would only be pressured to sell those securities and realize those losses under dire circumstances, such as if customers start withdrawing their money all at once and trigger a liquidity crisis. This is less likely to occur for extremely large banks such as Bank of America.

The Fed’s new liquidity facility should help alleviate those concerns for both regionals and Bank of America, as it would allow for them to take out loans from the Fed by using their Treasury securities as collateral and avoid realizing losses.

Although this should prevent banks that would have normally struggled to fund those withdrawals from shutting down immediately, it’s not a long-term solution. If deposits don’t eventually return, the bank would still be at risk, says Compton.

That’s mostly a concern for regional banks, as the existence of larger banks that are “too big to fail” is what is driving fears of a bank run away from the regionals. Investors are concerned that regional bank clients would switch to larger banks in an effort to avoid losing access to their deposits in the event of another bank collapse.

“If all these companies move something like half their balances there, then all these regional banks are in pretty big trouble,” Compton says.

Which Bank Stocks are Safer?

The GSIBs include large firms such as JPMorgan Chase, Bank of America, Wells Fargo WFC, and Citigroup—banks so critical to the operations of the global financial system that they’re unlikely to be allowed to collapse. As such, these banks are often considered as “too big to fail” because their collapse could have catastrophic economic consequences.

“We expect the events of the last several days are still likely to incrementally favor GSIBs, as the government backstop for these banks is a bit more secure,” says Compton. On top of that, GSIBs tend to have lower liquidity risk than regional banks.

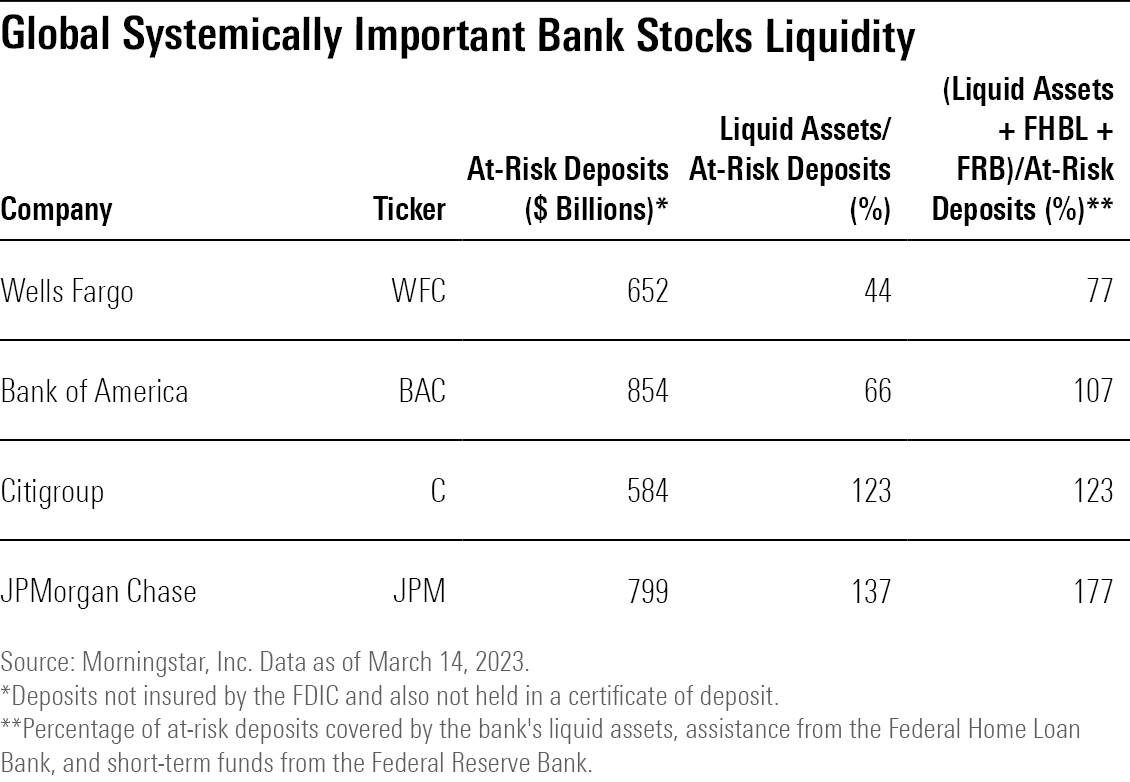

In the unlikely event that customers start drawing their deposits out of the GSIBs en masse, of the four that Compton covers, he found that JPMorgan Chase and Citigroup would be able to cover their deposits without having to resort to liquidity assistance from the Federal Home Loan Bank or the Fed’s discount window. These are options to increase cash levels outside of the Fed’s recently announced liquidity facility.

Bank of America would be able to cover its at-risk deposits with the assistance of those programs, Compton says.

Only Wells Fargo does not meet 100% of its at-risk deposits without having to consider at least a partial sale of securities if the Fed’s liquidity facility were not an option.

Furthermore, Compton views Wells Fargo as having a below-average liquidity risk. The bank would still retain a nearly 8% common equity Tier 1 ratio even in the unlikely scenario it has to sell its securities portfolio.